After working hard all week or month, it’s finally pay day! But when you get your payslip and see all those tax deductions, do you ever wonder if the right amount is being taken off you?

Nobody ever sits down to really tell you how to read a payslip, it is not something we are taught at school for example. For many people therefore it is a little bit of a mystery and trust is placed in employers to make calculations accurately and in Revenue to provide the correct information to employers. To help you spot when this system is not working quite as it should, getting yourself armed with a few of the knowledge basics is important.

In this, the third in our series of articles on better understanding your payslip, we cover the Universal Social Charge, or USC for short.

How is USC calculated?

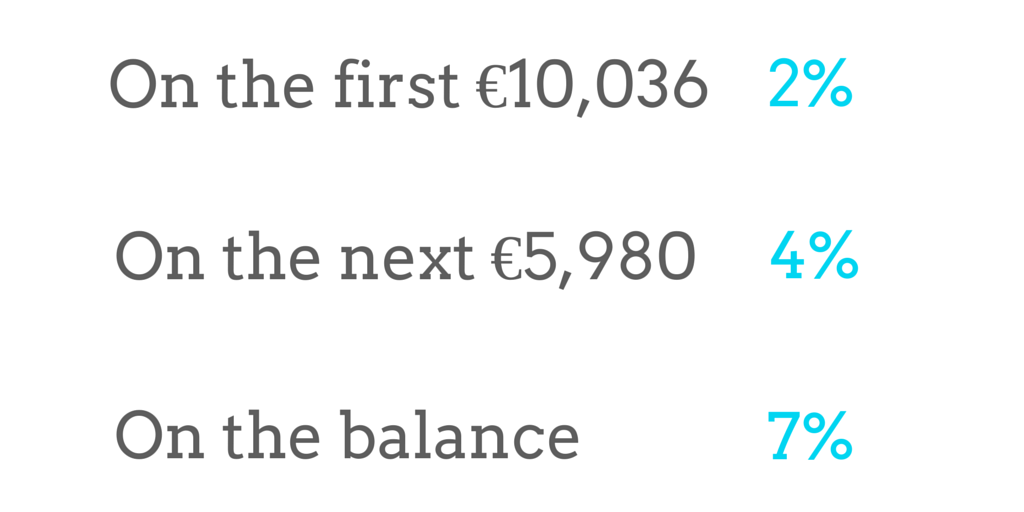

STANDARD RATES

USC is charged as a percentage of your gross income. The percentages change at different income threshold levels. The Standard Rates are:

REDUCED RATES

The Standard Rates above apply to the majority of people.However Reduced Rates apply to certain individuals as follows:

- Individuals who hold a full medical card and have total annual income of less than €60,000.*

- Individuals aged over 70 who have annual income of less than €60,000.

*Note that a GP only card is not considered a full medical card for the purposes of this exemption. This relief is also due to expire on 31 December 2014 unless extended in Budget 2015.

If you qualify for the Reduced Rates, you will avoid the 7% rate of USC. This means you pay 2% on the first €10,036 of your income and 4% on all of the remainder. The 7% rate does not apply at all.

Avoiding USC! There are some Exemptions!

There are also some exemptions to USC.

- If your total annual income is less than €10,036 you are exempt

- All income received from the Department of Social Protection is exempt

- Interest earned on deposit account savings is exempt

Paying Extra USC

A USC surcharge also applies to anyone who has non-PAYE income of over €100,000 per year. This mainly affects the self-employed. The surcharge is 3% which puts USC up to a whopping 10% for some people. This however is due to expire on 31 December 2014 unless extended in Budget 2015.

How do I work out how much USC I should be paying?

USC is charged on a cumulative basis, in a similar way to PAYE tax i.e. each pay period you pay a portion at 2%, a portion at 4% and a portion at 7%. You do not pay 2% for the first few months of the year until you have earned €10,036 and then increase to 4% and 7% as relevant thereafter.

If you are paid monthly, then the income threshold levels are divided by 12 to work out how much each month should be taxed at the 2%, 4% and 7% levels. If you are paid weekly, then the income thresholds are divided by 52 instead 12 (to reflect 52 weeks as opposed to 12 months).

For someone paid monthly, the Standard Rates of USC would be calculated as follows:

€10,036 / 12 = €836.33 x 2%

€5,980 / 12 = €498.33 x 4%

Balance of salary above €1,334.66 x 7%

For someone paid weekly, the Standard Rates of USC would be calculated as follows:

€10,036 / 52 = €193 x 2%

€5,980 / 52 = €115 x 4%

Balance of salary above €308 x 7%

Let’s look at an Illustration

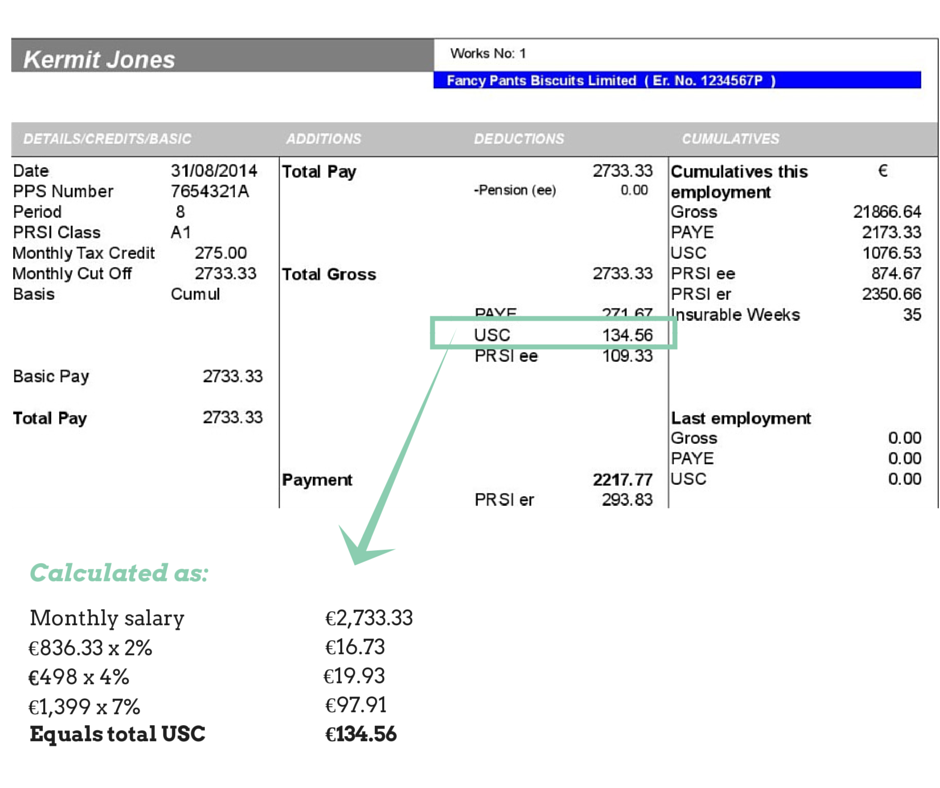

Let us return to Kermit Jones who we met in Part 2 of the Understanding Your Payslip series. (He is currently legally changing his name but the paperwork is proving slow).

If Kermit’s annual salary is €32,800, his monthly gross salary would be €2,733.33. Kermit pays the Standard Rates of USC. The USC payable on Kermit’s monthly salary would be calculated as:

€836.33 x 2% = €16.73

€498.33 x 4% = €19.93

€1,398.66 x 7% = €97.91

Equals total USC of €134.56

How do I check if I am paying too much USC?

Our tips are:

1.CHECK THE USC DEDUCTIONS IN YOUR PAYSLIP

Check the USC deductions in your payslip using our calculations outlined above, in case of any errors in your employer’s payroll system. Your employer must deduct USC on the basis of the rates shown on the Tax Deduction Card which they receive from Revenue for you. Occasionally we see issues with Tax Deduction Cards, such as an instruction to an employer to deduct USC at the 7% rate, with no allowances for the 2% and 4% thresholds. It is important to ensure Revenue have issued the correct information on your Tax Deduction Card and that your employer’s payroll system is calculating it correctly in line with Revenue’s instructions.

2. CHECK IF YOU ARE ENTITLED TO CLAIM THE REDUCED RATES

If you are entitled to pay the Reduced Rates of USC, make sure Revenue are aware of this and that they have issued a Tax Deduction Card to your employer which states that the 7% rate is not payable. Ensure your employer is not applying the 7% rate.

3. PERFORM A CHECK AT THE END OF THE YEAR FOR A POSSIBLE TAX REFUND

At the end of the year, look at your total earnings and your total USC paid. Use the above calculations to check that you did not overpay USC. Overpayments can arise in particular if you cease working before the end of the tax year. If this is the case, you can claim a tax refund.