On your payslip, you will see three main taxes being deducted from your salary. These are :

- PAYE (Pay As You Earn)

- PRSI Ee (Employees PRSI)

- USC (Universal Social Charge)

If you have elected to pay Local Property Tax through your employer, you will also see “LPT” as a deduction on your payslip.

This article is the 2nd part in our series on “Understanding Your Payslip”. It focuses on how the PAYE element of the total tax deduction is arrived at and how you can check that you are not paying too much PAYE tax.

How PAYE tax is calculated

Every individual is granted a “standard rate cut off point” and an amount of “tax credits”. These amounts are unique to the individual based on their own specific set of circumstances.

So what exactly are these?

STANDARD RATE CUT OFF POINT (SRCOP)

This is the total amount per year that you can earn which is taxed at the “standard” (currently 20%) rate of tax. Any amount over the SRCOP is taxed at the higher rate of tax (currently 41%).

TAX CREDITS

These are allowances which reduce the total tax you pay. Tax Credits are applied after first calculating how much tax you must pay at the 20% and 41% rate bands. There are different tax credits available for a wide range of different circumstances. However every individual will have the Personal Tax Credit and all PAYE employees (except proprietary company directors, which includes directors using an umbrella company) have the PAYE Tax Credit.

Illustrations based on unmarried PAYE worker (2014)

In 2014, the minimum SRCOP and Tax Credits available to an unmarried PAYE worker is a SRCOP of €32,800 and total Tax Credits of €3,300. So how would this person be taxed? Let’s call him Kermit (what can I say – his parents didn’t like him very much).

ANNUAL

If Kermit earned €32,800 in the year, the total PAYE taxes for the year would be calculated as:

€32,800 x 20% = €6,560

Less Tax credits = €3,300

Equals total PAYE tax €3,260

If Kermit earned €40,000 in the year, the total PAYE taxes for the year would be calculated as:

€32,800 x 20% = €6,560

€7,200 x 41% = €2,952

Less Tax credits = €3,300

Equals total PAYE tax €6,212

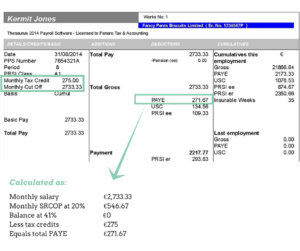

MONTHLY

However most employees are paid monthly or weekly, so it is helpful to understand how these taxes are calculated each pay period. If Kermit is paid on a monthly basis, then his SRCOP and Tax Credits are simply divided by 12 and he receives one twelfth of his annual entitlement each month. In the case of an unmarried PAYE worker with an annual SRCOP of €32,800 and Tax Credits of €3,300, therefore their monthly allowances would work out as:

€32,800 / 12 = €2,733.33

€3,300 / 12 = €275

If he were earning a gross annual salary of €32,800, this would be a gross salary of €2,733.33 per month. The taxes would be calculated as:

€2,733.33 x 20% = €546.67

Less Tax credits = €275

Equals total PAYE tax €271.67

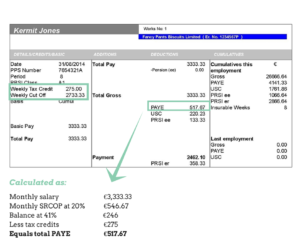

If he were earning a gross annual salary of €40,000, this would be a gross salary of €3,333.33 per month. The taxes would be calculated as:

€2,733.33 x 20% = €546.67

€600 x 41% = €246

Less Tax credits = €275

Equals total PAYE tax €517.67

The principal is exactly the same for persons paid weekly, except that you would divide the gross salary, SRCOP and Tax Credit figures by 52 instead of 12 (as you will have 52 weekly pay periods in a year instead of 12 monthly ones).

Basis of Tax – Cumulative vs. Week 1

If you are not paid a continuous fixed gross salary amount throughout the year from start to finish without any breaks, then it is important to be aware of the impact that the basis of tax may have on the above calculations. The most common basis of tax are Cumulative Basis and Week One basis. Take a quick look at our article explaining the difference between Cumulative Basis and Week One basis to understand how this may affect your payslip.

How do I check if I am paying too much PAYE tax?

There are two steps involved in checking that you are not paying too much PAYE tax.

1) Check that your employer is using the correct SCROP and Tax Credits

2) Check that Revenue are up to date with your personal circumstances

HOW DO I KNOW IF MY EMPLOYER IS USING THE CORRECT RATES OF SRCOP AND TAX CREDITS FOR ME?

The first thing to do is check the SRCOP and Tax Credits shown on your payslip against the Tax Credit Certificate that you should have received from Revenue at the start of the year. If you did not receive a Tax Credit Certificate, or have mislaid it, you can contact Revenue to ask for another one. Alternatively this is also available on PAYE Anytime and it is well worth registering for this online service if you have not already done so.

If there is a discrepancy between the details on your Tax Credit Certificate and the details on your payslip, you should discuss this with your employer. Sometimes the discrepancy may be as a result of errors in your employers payroll processing. However discrepancies can also arise where your full SRCOP and Tax Credits have not actually been allocated to your employer. For example if you had 2 separate employments at some point and your allowances were not transferred in full to your remaining employer after you ceased the 2nd employment. For confidentiality reasons, your employer is not privy to this type of information and can only calculate your taxes based on a version of your Tax Credit Certificate which Revenue provides to them. In these situations it is best to contact Revenue to ask them what is the amount of SRCOP and Tax Credits which have been allocated to your employer and you can then check if your employer is using the most up to date information.

HOW CAN I CHECK THAT REVENUE ARE GIVING ME THE CORRECT ALLOWANCES BASED ON MY MOST UP TO DATE PERSONAL CIRCUMSTANCES?

The second part of ensuring the correct rates of SRCOP and Tax Credits are being used for you is to make sure you have claimed all you are entitled to from Revenue. Revenue do not know everything about your own personal circumstances unless you tell them and make a corresponding claim for a relevant Tax Credit or change to your SRCOP.

To help give you an idea of what your SRCOP and Tax Credits should be based on your circumstances, take a look at our follow on article appearing shortly (link will appear here soon but in the meantime you can also check this at the Revenue website). You then compare the amount of SCROP and Tax Credits which Revenue has granted you on your Tax Credit Certificate against the amounts that you feel you are entitled to.