Tax relief on business expenses are not just for the self-employed. If you are a PAYE employee you may be entitled to tax relief based on your occupation by claiming Flat Rate Expenses.

Flat rate allowances are a type of tax relief available for expenses incurred in the performance of your duties of employment. Many employees incur expenses related to their employment such as paying for tools or uniforms for example.

It is called “flat rate” because the amount is the same for all employees within the occupation, regardless of how much expense they actually do incur. This means there is no need to keep receipts. The amount available to each category of employee is agreed between Revenue and representatives of the employee groups, such as a trade union.

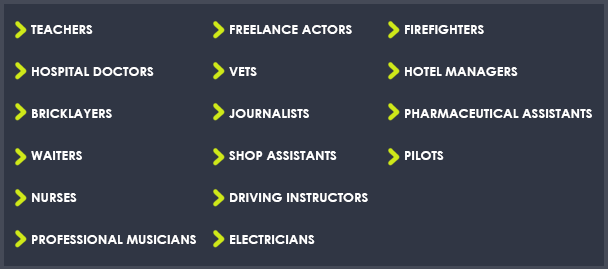

Which occupations are entitled to Flat Rate Expenses?

A wide range of occupations are entitled to Flat Rate Expenses tax relief. This includes:

This list is not exhaustive and is intended to give a good overview of the range of occupations eligible for Flat Rate Expenses. A full list is available at the link we’ve provided a little further down.

How much is the tax relief?

The tax relief varies by occupation. A freelance actor who is taxed under PAYE is entitled to Flat Rate Expenses of €750 whilst a bricklayer is entitled to €175.

You can check out the full list of Flat Rate Expenses entitlements on Revenue’s website here.

Using that list you can check if your occupation is listed and how much you are entitled to.

Flat rate expenses are not a tax credit. They work by reducing your taxable income. That is, if your salary was €20,000 per year and you were entitled to flat rate expenses of €200, the amount of the salary that you are taxed on is €19,800.

How do I claim my Flat Rate Expenses tax relief?

The quickest and easiest way to claim Flat Rate Expenses is through PAYEAnytime, which is available online via Revenue’s MyAccount facility.

Don’t forget you can claim tax relief for up to 4 prior tax years as well as the current year. If you’ve never claimed Flat Rate Expenses before, make sure you claim your last 4 year’s entitlement now!