As a professional service contractor (someone who provides services on an independent basis to businesses), the process of getting your taxes and payments in order can be stressful, confusing and time-consuming.

At Fenero, we offer a range of Private Limited Company or Umbrella Company solutions specially designed for contractors to maximise tax efficiency and net take home pay while also minimising the pressures of dealing with admin and paperwork.

Click here to read more about these contractor solutions.

But what exactly are Private Limited Companies or Umbrella Companies? To help clear up the meaning of these two concepts and how they apply to contractors, we have compiled a simple guide that outlines the structure of either solution.

Tax Basics: Breaking Down The Jargon

For contractors, the legal structure of a company can have a huge impact on not only day to day operations, but the ways in which a contractor pays tax.

Limited companies have special legal status. They are known as incorporated, therefore the business has its own legal identity which is separate to the people who own them. For example, companies can own assets or sue in its own right.

Ownership of a limited company is divided into parts called shares and an owner of a share is known as a shareholder. Shareholders are not personally responsible for any company debts.

Umbrella Companies are limited companies and therefore operate under the same legal requirements and rules as other limited companies. Umbrella companies are a term used within the contracting sector. An umbrella company is a company which is used by contractors for invoicing and getting paid for the services they provide.

What Is a Private Limited Company?

A Private Limited Company is a type of privately held small business entity. As with all limited companies, these have a wide range of reporting and tax requirements to meet.

Private Limited Companies exist in their own right, as separate legal entities to the contractors who own and use them. This means that income, outgoings and debts and profits belong to the company. As a contractor, you extract your income from the company primarily by taking salary payments from the company.

In the context of contracting, a Private Limited Company solution means that a new limited company is set up exclusively for you. It is owned 100% by you and you are the only contractor who will ever use it. When you have finished contracting and no longer have a need for the company, you must follow a legal close down process for the company.

You will usually need the services of an accountant to fulfil all the tax and accounting reporting requirements. Using an accountant with experience and in-depth knowledge of contracting is important to maximise the benefits of using a private limited company as a contractor.

An advantage of contracting through a Private Limited Company instead of using an Umbrella Company, is that you have much greater control over wealth management options. This means you have greater control over how you structure your salary payments, how you fund a pension and other options for maximising the financial benefits of your contract. A Private Limited Company solution is often the best choice if you are contracting for the long term or if you earn high daily rates.

What Is an Umbrella Company?

In the contracting industry, an Umbrella Company is a term which refers to a limited company used by multiple contractors at the same time. It is centrally managed from an administrative and legal perspective by a service provider. When you have finished contracting, you leave the Umbrella Company and the Umbrella Company will continue to be used by other contractors.

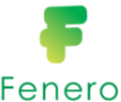

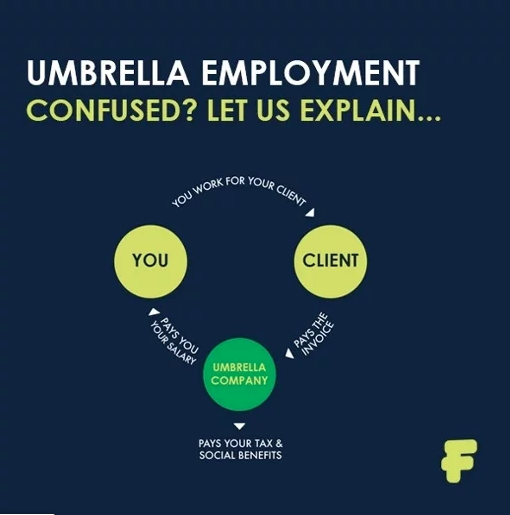

An Umbrella Company is operated by a specialist third party professional service provider and the company acts as an employer to contractors for payroll purposes. Essentially, an Umbrella Company is an intermediary between a contractor and their clients.

Under the Umbrella Company option at Fenero, a contractor becomes a PAYE employee of the Umbrella Company for taxation purposes and can choose between becoming either a standard employee or a director and shareholder of the company.

Contractors are required to complete and submit time sheets showing their hours worked to the Umbrella Company. If the contractor incurs any business expenses related to their contract, they submit these to the Umbrella Company also. The Umbrella Company then takes care of any bookkeeping by raising invoices and collecting payments from a client and subsequently arranging onward payment to the contractor as a salary with relevant taxes, PAYE, PRSI, USC and their Umbrella Company fee deducted.

Click here to read about Umbrella Companies in more detail.

An advantage of contracting through an Umbrella Company is that it is a very straight forward pay-as-you-go type service. A contractor can be set up instantly with an Umbrella Company and it can be easily used for short term contracts. It is generally cheaper to use an Umbrella Company than to operate through your own Private Limited Company. Umbrella Companies are an excellent option for first time contractors exploring the world of contracting or for contractors who have short term contracts.

Still need help? Get in touch for advice on choosing the best option to suit your needs as a contractor, or take a look at our post on the pros and cons of contracting.