Claiming tax refunds on medical costs is one of the most common forms of tax relief and one of the easiest to claim. However, every year there are a large number of people who don’t claim what they are entitled to.

You can get tax back on medical expenses such as GP costs, prescribed drugs and medicines, hearing aids, maternity care and much more. Don’t leave that cash in the taxman’s pocket rather than yours!

Can I get a tax refund on all kinds of medical expense?

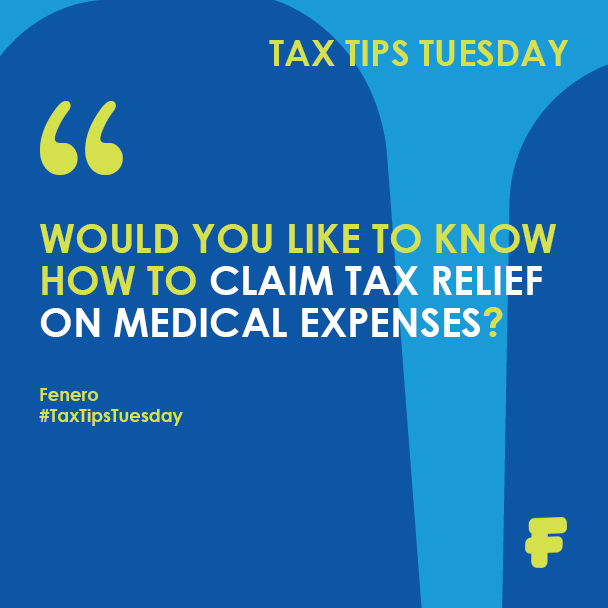

Tax relief is only available on “qualifying” medical expenses. However the good news is that this does include a very wide range of health costs. A full list is available in Revenue’s guide IT6

Here’s some of the most common allowble expenses:

What about dental expenses?

Tax refunds are not available on routine dental costs such as check ups and cleaning. You can claim tax relief on “non-routine” dental expenses, but you must obtain a signed Med2 form from your dentist first.

Examples of allowable “non-routine” dental expenses are root canal treatment, crowns, veneers and orthodontic treatment.

How much will my tax refund be?

Tax relief is available at 20% of the cost of qualifying medical expenses.

Example:

In 2016, you incur a total of €1,200 in qualifying medical expenses. You are entitled to 20% of this back as tax relief. So your tax refund will be €240.

My health insurance covers some of my medical costs – does this affect my tax refund?

You are only entitled to a tax refund on the cost of medical expenses less any amounts covered by your health insurance.

Example:

In 2016, you incur a total of €1,200 in qualifying medical expenses. You receive €200 of this back via your health insurance. So the cost to you after insurance refunds is €1,000.

You are entitled to 20% of this back as tax relief. So your tax refund will be €200.

What proof do I need to get a tax refund?

Keeping track of your medical receipts is essential. You might be asked to produce them as evidence whilst Revenue process your claim or even after it has been processed as part of a follow up audit.

Tax Tip

Here’s a little tip to ensure you don’t mislay receipts and lose out on tax relief. Simply take a photo of your receipt as soon as you are given it. Email the photo to yourself and label your email as “Medical Expense”. This will mean you can easily access all your receipts in one place at the end of the year when claiming your tax refund.

Or you check out Revenue’s free app – PAYE Health Expenses Tracker. It has mixed reviews but you might want to take a look.

How do I organise my tax refund?

If you are self-employed or have to file an income tax return for any reason, you claim the tax relief on medical expenses when preparing your income tax return. Fenero are experts with Irish Income Tax Returns, so don’t hesitate to get in touch for help with this.

If you are a PAYE employee, the quickest and easiest way to claim is online via Revenue’s MyAccount facility.

If you don’t want to go online, you can complete a Form Med1 and send it to Revenue via post.

I pay medical expenses for my family members – can I claim these costs?

Yes, you can claim tax refunds on the cost you have incurred for qualifying medical expenses which you have paid on behalf of any individual.

I’ve never claimed a tax refund on medical expenses before!

Don’t worry – Revenue let you claim tax refunds for medical expenses for the last 4 years. So gather up your old receipts and get your claim in!

Claiming money back from your health insurance

Don’t forget that cash back isn’t just due your way from Revenue. Even the most basic health insurance policies cover some day to day medical costs. While you are gathering together your receipts, don’t forget to claim against your insurance as well as the taxman!