With an overall package of €14 billion, Budget 2024 has been framed as helping with the needs of today, whilst also planning for the next 10, 20, 30 years. What does that mean in practical terms?

Of the €14 billion Budget 2024 package:

- €1.1 billion relates to income tax measures

- €5.3 billion relates to core expenditure measures

- €2.7 billion relates to once-off cost of living measures

- €4.75 billion relates to “non-core” expenditure

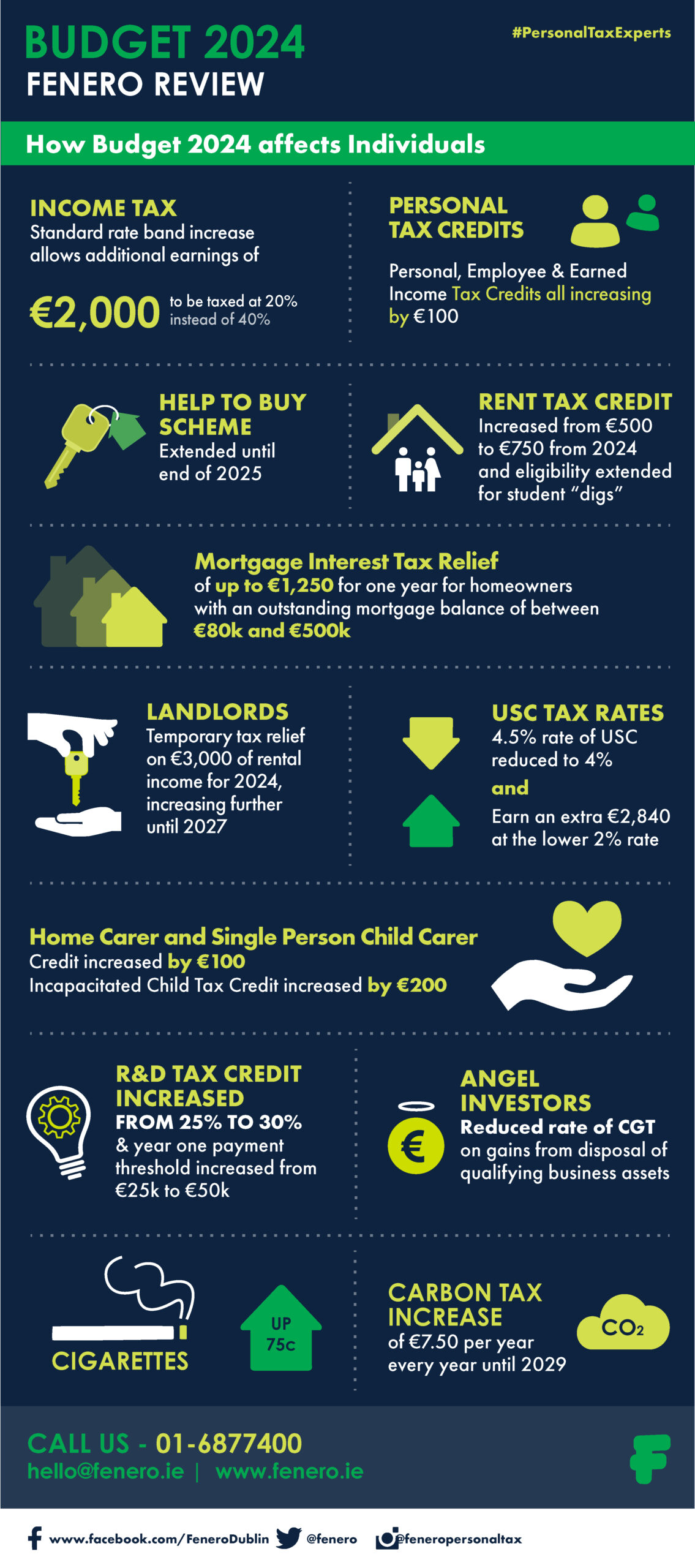

In our infographic and article below, we’ve summarised some key takeaways, including how the changes in tax rate bands and personal tax credits can add up to €892 of tax savings.

Key takeaways

For a full written overview of the key takeaways, scroll down or click here.

“By any measure, Ireland is a modern, successful country, but we know we can do better, and we will.”

Michael McGrath, Minister for Finance, 10th October 2023

PERSONAL TAX

There are a number of changes to personal taxation on income announced in the budget. Changes in the 20% tax rate bands, personal and employee or earned income tax credits, and the small change to the USC rate band, can add up to €892 of tax savings.

The maximum amount of €892 will apply to those who pay tax at the higher 40% rate, earning €70,000 per year. By comparison, someone earning €42,000 will see tax savings of €752.

This can increase if you are entitled to further tax credits in addition to the standard credits (Personal Tax Credit, Employee Tax Credit and Earned Income Tax Credit).

Tax Credits

There is a €100 tax credit increase for the Personal Tax Credit, Employee Tax Credit and Earned Income Tax Credit, meaning these tax credits will become worth €1,875 in 2024.

20% Tax Rate Band

The 20% income tax rate band (known as the “standard rate band”) is increasing by €2,000. This will allow you to earn up to €2,000 more which is taxed at the lower 20% tax rate instead of the 40% tax rate.

Carer Related Tax Credits

Additionally there is an increase of €100 in the Home Carer Tax Credit and the Single Person Child Carer Credit. The Incapacitated Child Tax Credit will be increased by €200.

USC

The 2% USC rate band will be increased slightly, allowing you to earn an additional €2,840 at the 2% rate before moving into the next higher rate.

The 4.5% rate of USC will be reduced to 4%.

RENTERS, HOMEOWNERS & LANDLORDS

Tax Credit for Renters

The tax credit for renters is being increased from €500 to €750 from 2024.

Eligibility for the rent tax credit is also being extended to parents who pay for their student children’s rental accomodation in the case of Rent A Room accommodation or “digs”. In good news, this will also be applied retrospectively for 2022 and 2023, so don’t overlook claiming back tax relief on this if it’s relevant to you.

Help-To-Buy Scheme

The Help-to-Buy scheme will be extended until the end of 2025.

Landlords

A temporary tax relief is being introduced for landlords. Subject to certain conditions being met, rental income of €3,000 for the year 2024, €4,000 for 2025 and €5,000 for the years 2026 and 2027, will be taxed at the 20% tax rate band.

An important condition of this measure is that the properties held by the landlord must remain in the rental market for 4 years to 2027, otherwise the full amount of the tax relief will be clawed back. There is no clawback after the end of the 4 year period.

Homeowners

A temporary Mortgage Interest Tax Relief is being introduced for 2024 for certain homeowners i.e. those who had a mortgage balance of between €80,000 and €500,000 at 31 December 2022.

Tax relief will be available in relation to the increased interest paid on the mortgage in the calendar year 2023 as compared with the amount paid in 2022, at the standard rate of 20% income tax. The relief will be capped at €1,250 per property.

INDIRECT TAXES

Cigarettes

Efforts to discourage smokers continue, with excise duty on cigarettes rising again – up 75 cent on a packet of 20 cigarettes, with a pro-rata increase from other tobacco products.

VAT changes

- A change in the VAT registration thresholds for businesses will be taking effect. The level of turnover is increasing from €37,500 to €40,000 for services, and from €75,000 to €80,000 for goods, before a business must register itself for VAT.

- Audio books and e-books are to be treated like printed books from a VAT perspective from 1 January 2024. VAT on audio books and e-books will be reduced to zero percent from 1 January 2024.

- The 9% temporary reduced rate of VAT for gas and electricity will be extended for a further 12 months, until 31 October 2024.

ENTREPRENEURS & INVESTORS

Research & Development (R&D) Tax Credit

There will be an increase to the R&D tax credit from 25% to 30% of qualifying research and development expenditure. This will apply to 2024 expenditure.

Additionally, there will be an increase of the first year payment threshold from €25,000 to €50,000 to support improved cash flow for businesses claiming the R&D tax credit.

Reduced CGT for Angel Investors

A new reduced rate of 16% CGT is being introduced for Angel Investors on qualifying investments.

The relief will be available to an individual who invests in an innovative start-up SME business for a period of at least 3 years. Certain conditions apply including that the investment must be made in the form of fully paid-up newly issued shares costing at least €10,000 and must account for between 5% and 49% of the total share capital of the company.

There will also be a lifetime limit on this relief of a maximum of €3 million of gains to which this reduced CGT rate will apply.

ENERGY COSTS FOR HOUSEHOLDS

Households

Further support is being provided for households with increased energy costs again this year, in the form of a total of €450, spread over three payments of €150.

STAY INFORMED – WE’RE HERE TO HELP

For any initiatives where timelines are unclear at this time or further details are to follow from government in the coming days and weeks, follow Fenero on LinkedIn to be kept up to date with relevant and important news.