On the back of the pandemic, Budget 2022 seeks to support living cost pressures whilst also focusing on higher levels of national debt which are forecast to come in at just under €240 billion next year, which is equivalent to €50,000 per person in the country.

There are a number of personal tax (i.e. income tax, USC and PRSI) changes, as according to Minister for Finance, Paschal Donohue, “we have been conscious of the cost of living pressures that are currently confronting citizens”.

Key takeaways

For a full written overview of the key takeaways, scroll down or click here.

“The last time I announced a budget in this chamber two years ago, none of us could have foreseen that the worst global pandemic in a century awaited. In framing this Budget, we have been conscious of the cost of living pressures that are currently confronting citizens and businesses. Budget 2022 meets the twin goals of investing in our future, of meeting the needs of today, while putting the public finances on a sustainable path. Overall, more than 400,000 jobs will be added to the economy between this year and next, and employment is expected to reach and exceed its pre-pandemic level during the course of 2022. This performance, by any measure, represents a remarkable rebound in our jobs outlook. We are recovering.”

Paschal Donohoe, Minister for Finance, 12th October 2021

PERSONAL TAX

The Budget contains a number of changes to personal taxation on income.

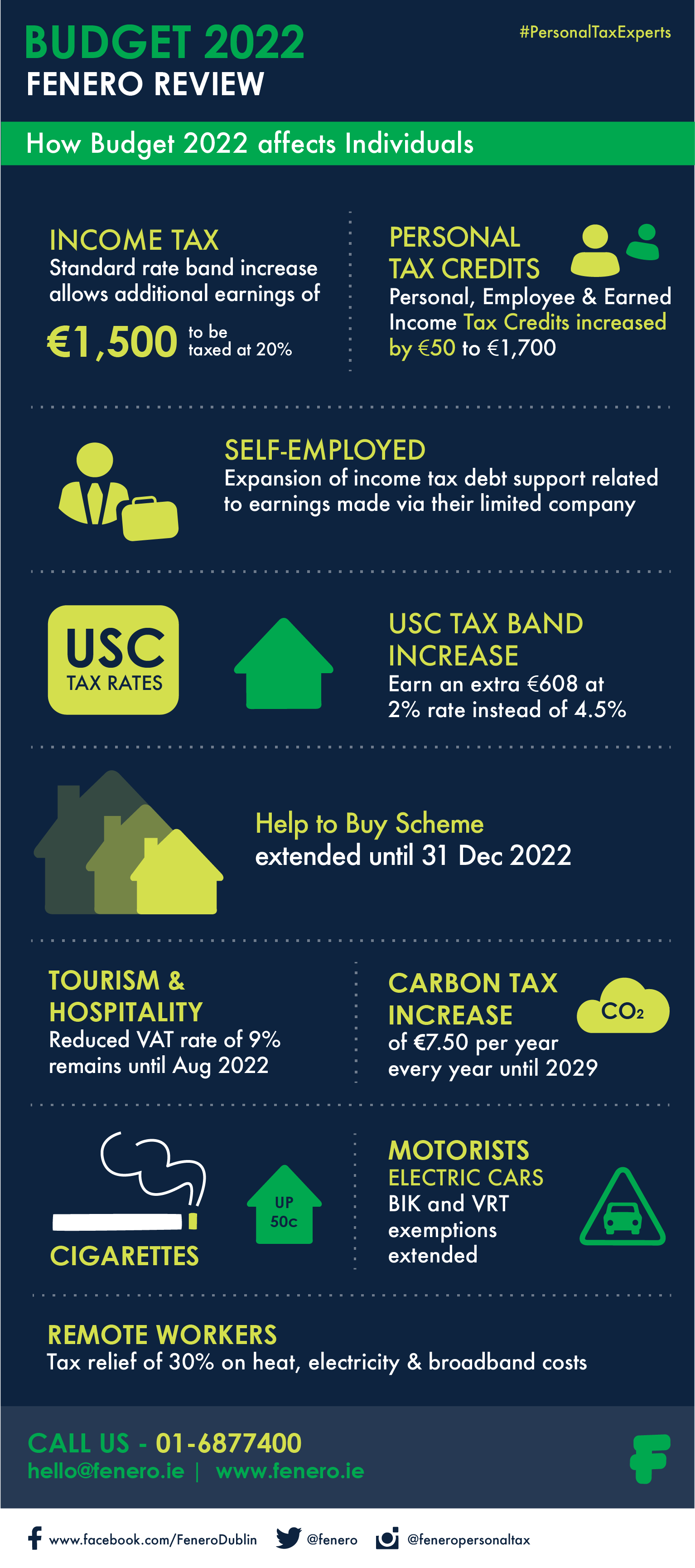

Tax Credits

There is a €50 tax credit increase for the Personal Tax Credit, Employee Tax Credit and Earned Income Tax Credit, meaning these tax credits are now worth €1,700.

20% Tax Rate Band

The 20% income tax rate band (known as the “standard rate band”) is increasing by €1,500. This will allow you to earn up to €1,500 more which is taxed at the lower 20% tax rate instead of the 41% tax rate.

USC

The 2% USC rate band will be increased slightly, allowing you to earn an additional €608 at the 2% rate before moving into the 4.5% rate.

Additionally, the current exemptions from the top rate of USC have been retained for all medical card holders and those over-70 who are earning less than €60,000.

ENTREPRENEURIALISM & SELF EMPLOYED

Earned Income Tax Credit

As mentioned above, the Earned Income Tax Credit for the self-employed, is being increased to €1,700.

Warehousing of Tax Liabilities

The tax debt warehousing scheme will be expanded to allow self-assessed income taxpayers with employment income to warehouse income tax liabilities relating to their salary income from that employer company.

The existing tax debt warehousing support was not previously available to this income for the self assessed; this was seen as harsh and is now being corrected.

Corporation Tax

The government has taken the historic decision to join the global political agreement on the future of corporate taxation.

An increased rate of 15% for corporation tax will apply for companies with turnover in excess of €750 million per year. No date was confirmed about when this new rate of corporation tax will be introduced.

However, the 12.5% will continue unchanged for businesses with annual revenues of less than €750 million.

Employers PRSI

The weekly income threshold for the higher rate of employer’s PRSI will increase from €398 to €410 from 1 January 2022. This follows a recommendation of the Low Pay Commission to ensure that the increased hourly minimum wage of €10.20 to €10.50 does not lead to work disincentives for workers, in particular those seeking to work full-time.

REMOTE & HOME WORKING

Government policy is to facilitate and support remote work. Budget 2022 announces an income tax deduction for 30% of the cost of vouched expenses for heat, electricity and broadband in respect of those incurred while working from home.

There was no mention of the current eWorker Allowance, but it is assumed that this will remain in place at its current flat rate of €3.20 per day as the alternative option for claiming tax relief on home light and heating costs.

If you are interested to read more about tax reliefs on expenses for contractors when working from home at, check out our blog post: https://www.fenero.ie/knowledge/covid-19-working-from-home-what-expenses-can-i-claim/

HOMEOWNERS & LANDLORDS

Help-To-Buy Scheme

The Help-to-Buy scheme will be extended in its current “enhanced” form for 2022. A full review of the Help-To-Buy Scheme will be conducted next year.

Landlord Pre-Letting Expenses

In a bid to encourage landlords in the residential rental sector to return empty properties to the market as quickly as possible, Budget 2022 is extending the relief for pre-letting expenses for landlords for a further three years.

MOTORISTS

The government’s commitment to lowering emissions from road transport continues in Budget 2022 measures.

Carbon Tax

The Finance Act 2020 provided for annual increments in the carbon tax of €7.50 out to 2030. The €7.50 increase for 2022 continues as planned.

BIK on Electric Vehicles

The BIK exemption for electric vehicles is being extended until 2025. From 2023 the relief will apply by reducing the original market value of an electric vehicle by €35,000; this reduces to €20,000 for 2024, and €10,000 for 2025.

In addition, an extension of the €5,000 relief for Electric Vehicles to the end 2023 to further encourage the uptake of electric vehicles.

If you are a contractor interested in purchasing a vehicle through your Limited Company, contact us for more information on the expert services and solutions we offer to contractors to help you minimise your tax liabilities and maximise your earnings.

Vehicle Registration Tax (VRT) and Motor Tax

Cars with higher emissions will see an increase in VRT. A revised VRT table is being introduced from January 2022 which will increase the current VRT rates on higher emission vehicles in the following bands as follows:

- 1 per cent increase for vehicles that fall between bands 9-12

- 2 per cent increase for bands 13-15

- 4 per cent increase for bands 16-20

Lower carbon-emission vehicles

The Accelerated Capital Allowance scheme for gas and hydrogen powered vehicles and refuelling equipment is extended for three years.

In addition, the scheme will be expanded to encompass hydrogen-powered vehicles and refuelling equipment. Hydrogen offers significant carbon savings as a carbon neutral renewable energy and has been identified as a key element of a wider cross-sectoral shift to a net-zero carbon future for Europe.

INDIRECT TAXES

Cigarettes

Efforts to discourage smokers continue, with excise duty on cigarettes rising again – up 50 cent on a packet of 20 cigarettes, with a pro rata increase from other tobacco products.

VAT rate for Hospitality Sector

The reduced VAT rate of 9% for the hospitality sector will remain in place to the end of August 2022.

STAY INFORMED – WE’RE HERE TO HELP

For any initiatives where timelines are unclear at this time or further details are to follow from government in the coming days and weeks, follow Fenero on LinkedIn to be kept up to date with relevant and important news.

Multi-Award Winning Tax Experts In All Things Contracting!

Fenero are multi-award winning friendly tax specialists and experts in all things contracting. We are straight-talking tax and financial experts, with a single-minded mission to deliver market leading customer experience; fast, friendly, informative service and great value fees.

Reasons why Contractors choose Fenero include:

- 24/7 Access to myFenero online platform

- Dedicated Account Manager

- Google Reviews rating 4.9/5

- Winners: 2021 & 2019 Customer Experience Impact in Professional Services

- Winners: 2020 Tax Team of the Year

- Winners: 2019 Accountancy Practice of the Year

- Great value fees

- Comprehensive insurance coverage

- Multiple money-back service level guarantees

- Contractor Wellbeing Programme – free medical and counselling services and discounted health insurance plans

- Financial and Tax Planning Support

- 12 years + experience

- Process €100m+ contractor payments annually

We are proud winners of Tax Team of the Year 2020 and Accountancy Practice of the Year 2019 in the Irish Accountancy Awards and also the CX Impact in Professional Services Awards in the 2021 and 2019 Irish Customer Experience Impact Awards! So talk to the best in the industry for all the expert tax and financial advice you need to maximise the financial benefits of contracting!

For more information on getting started in contracting or to get a free illustrative calculation showing how much you can earn as a professional contractor, drop a line to the friendly, expert crew in our Solutions Team.