How will individuals be affected by changes in Budget 2019?

In what has been billed as an “election” and “spending” budget, the announcements on Budget Day contained few surprises after being heavily leaked to the public in advance.

The reality is this Budget, for the most part, is a “steady as she goes” set of announcements, with the Minister targeting a balanced budget next year. This has meant little significant tax change which will impact the majority of individuals.

Personal tax rates in Ireland continue to be very high. These impact on Ireland’s ability to attract and retain talent at a time of continued skills shortages to meet the ongoing growth demands in key sectors of the economy.

Ireland has a commendable progressive system for income tax in the context of global comparisons, but our higher tax rates kick in at a relatively low level of earnings, despite even the government accepting that rates are too high and risk Irish competitiveness on the global stage. With only minor changes affecting personal tax rates this year, significant improvement in the personal tax system has been kicked down the road for another while to come.

Key takeaways

For a full written overview of the key takeaways, scroll down or click here.

“This Government believes that workers enter the higher rate of income tax at too low a level of income. We cannot hope to remain competitive if someone who is on a relatively low income works overtime and has nearly half that extra money taken in tax.”

Paschal Donohoe, Minister for Finance, 9th October 2018

PERSONAL TAX

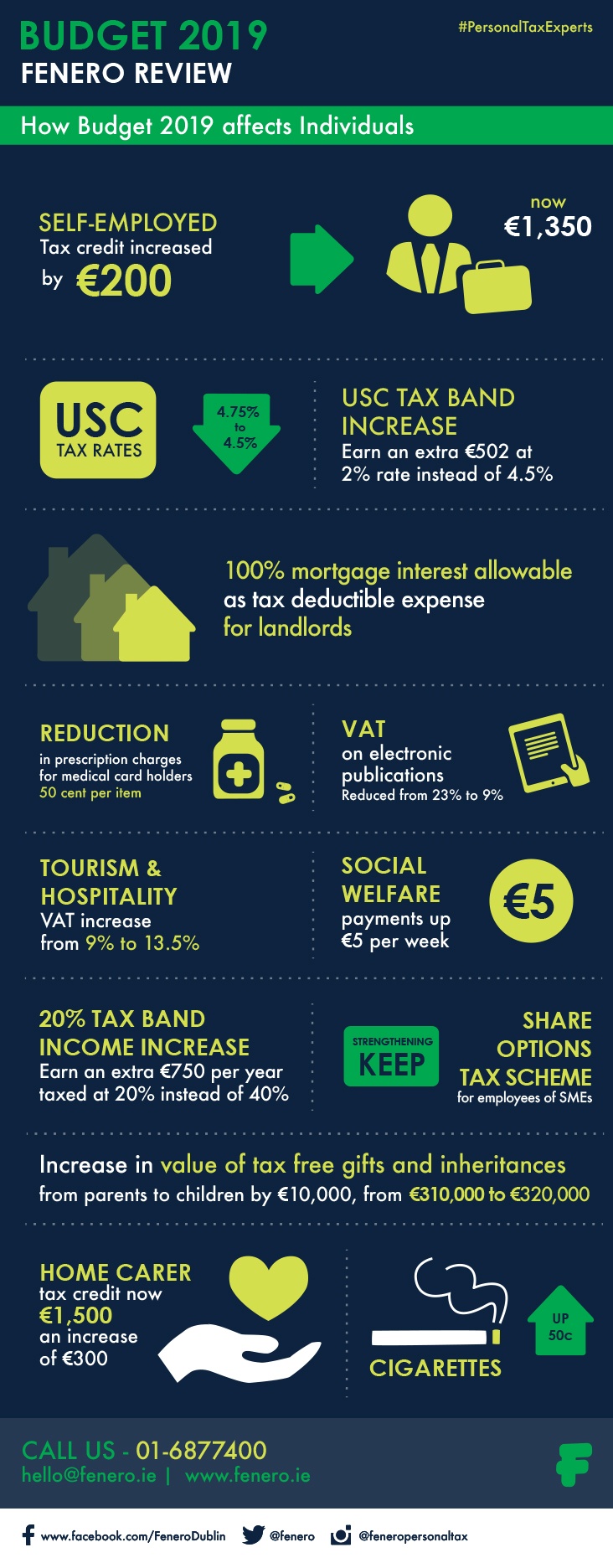

The threshold for the 20% tax rate band will be increased. You can now earn €750 more at the lower rate of tax before moving into the 40% tax rate band.

The 4.75% rate (which was decreased from 5% in last year’s Budget) will be decreased further, to 4.5%.

The 2% USC rate band will also be increased slightly, allowing you to earn an additional €502 at the 2% rate before moving into the 4.5% rate.

The home carer tax credit (which was increased by €100 in last year’s Budget) will increase again this year, by €300 bringing the total tax credit value up to €1,500.

LANDLORDS

Several years ago now, landlords were entitled to claim the full amount of their mortgage interest as a tax deduction on their income tax return. During the economic crash, the amount of mortgage interest was restricted to 75%, which had an major impact on most landlords tax bills due to mortgage interest typically being landlords largest cost. The allowable percentage was increased to 80% in recent years, and is now being fully restored to 100%.

ENTREPRENEURIALISM & SELF EMPLOYED

In line with multi-year promises to bring the self-employed closer into parity with employees, the Earned Income tax credit for the Self-Employed has been increased by a further €200 again this year to now bring it’s value up to €1,350. The self-employed still pay a higher level of tax compared to employees, but the gap is closing.

The much discussed KEEP (Key Employee Engagement Programme) scheme which was launched in last year’s Budget is being strengthened, due to much lower than anticipated take up of the scheme. The scheme can be used by SMEs to offer tax efficient share options to employees, with the goal of providing SMEs with more tax efficient options to remunerate, reward and retain key employees.

CAPITAL ACQUISITIONS TAX

The total value of gifts and inheritances which can be passed from parents to children on a tax free basis, has been modestly increased by €10,000 to a total of €320,000.

INDIRECT TAXES

Efforts to discourage smokers continue, with excise duty on cigarettes rising again – up 50 cent on a packet of 20 cigarettes.

The VAT rate on electronic publications is being reduced from 23% to 9%.

Despite strong lobbying from the sector, the VAT rate on hospitality and tourism related services is being restored to 13.5% after a number of years at the reduced 9% rate which had been introduced during the economic crisis to provide stimulus for this struggling sector of the economy.

DO YOU HAVE MORE QUESTIONS?

Fenero are personal tax experts specialising in tax services to contractors, freelancers, and landlords. If you have any questions about Budget 2019 and how it effects your income tax, feel free to drop us a line.